How to Build Client Trust as a Financial Planning Coach

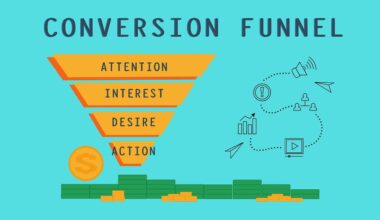

Building client trust is vital for any financial planning coach aiming to succeed. Trust forms the foundation of a healthy coach-client relationship, allowing clients to feel secure in sharing their finances. Start by establishing open lines of communication where clients can express their thoughts and concerns. Highlight your credentials and experience, showcasing your expertise and knowledge in financial planning. Sharing testimonials from previous clients can also be an effective way to enhance your credibility. Make a conscious effort to listen actively, ensuring clients feel fully understood. Demonstrating empathy and respect towards their situations will significantly strengthen trust. Setting clear expectations about what clients can expect from your coaching process contributes to their sense of security. Be transparent about your fees, the duration of sessions, and what kind of results your clients can realistically anticipate. Create a personalized financial plan that reflects each client’s unique goals and aspirations, reinforcing that you prioritize their needs. Remember that trust is built over time, so it’s essential to be consistent in your actions and keep your promises for long-lasting relationships.

Another vital component in fostering client trust is delivering on your promises. Clients need to see results and feel confident that their financial situation is improving under your guidance. Follow through on commitments, whether it’s providing them with a detailed plan or checking in regularly. Consistency in your approach demonstrates that not only do you care, but also that you are effective in guiding them toward achieving their financial goals. Schedule regular progress sessions to discuss what’s working and make any necessary adjustments to the plan. Asking for their feedback will make clients feel involved in the process and valued as participants rather than just observants. It can also provide you with insights that improve your coaching methods. Utilize tools like financial planning software that offer transparency, allowing clients to visualize their progress. This transparency builds accountability and fosters more trust in the relationship. Strive to create a supportive and constructive environment for difficult conversations about finances. Address any mistakes or misjudgments openly and honestly. When clients see your authenticity, they are more likely to trust you further.

Creating a Personalized Client Experience

Creating a personalized experience for each client can significantly enhance their trust in you as a financial planning coach. Start by conducting an in-depth initial consultation where you gather essential information about their financial goals, challenges, and dreams. This information can help you craft a custom coaching strategy that resonates with their unique situation. Be open to adapting your approach based on each client’s individual preferences, learning styles, and needs. This adaptability shows clients that you value their individuality and are willing to go the extra mile. Incorporate educational components, offering insights and resources tailored specifically to their circumstances. Use clear and accessible language when discussing financial concepts. This approach demystifies complicated topics, enabling clients to grasp the intricacies of their situation effectively. Regularly check in to evaluate not only their financial state but also their emotional comfort with the progress made. If clients feel understood and cared for beyond just their financial matters, the trust will deepen. Establishing this familial connection conveys that you genuinely invest in their financial well-being, cultivating lasting loyalty.

Another essential aspect of building client trust lies in demonstrating your commitment to staying current in the field of financial planning. Be proactive in pursuing continuing education through courses, certifications, and industry conferences. Share relevant insights and trends with your clients, positioning yourself as a knowledgeable authority. This practice not only benefits your expertise but also reinforces clients’ confidence in your ability to navigate the evolving financial landscape. Encourage clients to engage with financial literature, podcasts, and other resources. By doing so, they understand that they are not solely relying on you for knowledge but are also part of their financial education. This engagement fosters a collaborative environment where both coach and client benefit from shared learning, creating a dynamic trust-building experience. Attend workshops and networking events to build relationships with other professionals in related fields. Establishing connections with other experts gives clients more resources and reinforces your commitment to their financial success. Trust is not merely a product of one person’s expertise; it’s the collective effort of a network working towards a common goal.

Encouraging Client Independence

Encouraging client independence is an admirable strategy that helps build trust over time. Clients who feel empowered and knowledgeable about their financial situations tend to trust their coach more. Guide your clients to set realistic and achievable financial goals that they can actively work towards. Provide them tools and skills that enable them to make informed decisions, rather than relying solely on you for answers. Share educational resources and materials that promote financial literacy. Conduct workshops or webinars on various financial topics that concern them. This not only showcases your expertise but also encourages active client participation in the planning process. When clients feel they are equipped with the right tools and knowledge, their trust in you as a coach deepens significantly. Celebrate small victories together, emphasizing their progress instead of just focusing on long-term outcomes. Recognize the importance of patience and growth, fostering an understanding that financial planning is a long-term journey rather than a quick fix. Acknowledging your clients’ efforts boosts their confidence and fosters a deeper relationship.

Utilizing technology effectively is yet another strategy to build trust with your clients as a financial planning coach. In today’s digital age, many clients prefer online solutions that offer convenience and accessibility. Incorporating reliable financial planning software can provide transparency and a sense of control over their financial data. Choose tools that allow clients to visualize their financial progress through charts and reports, making the data more digestible. Offer online consultations if clients prefer remote communication for convenience. Ensure that any technology you implement is user-friendly and secure, as clients must feel safe sharing sensitive data. Regularly seek client feedback regarding the technology solutions you use, demonstrating your willingness to adapt to their preferences. Moreover, stay informed about new financial apps or platforms they may find useful. This practice shows you care about their experience and are continually seeking ways to enhance their financial journey. Lastly, keep channels of communication open and provide support for any technical challenges they might face. Building trust through technology reflects your commitment to a modern and professional coaching experience.

Establishing Long-Term Relationships

Establishing long-term relationships is crucial for fostering trust as a financial planning coach. As clients navigate their financial journey, they will face various life transitions that might require your guidance and support. Demonstrate your commitment to standing by their side through challenges and changes. Regular follow-ups and check-ins will assure clients that you are invested in their ongoing financial well-being, nurturing a collaborative partnership. Create opportunities to connect during significant milestones, such as retirement planning or preparing for a child’s education. These moments reveal that you value their financial journey as just as much as they do. Provide periodic evaluations to assess their financial plans and adjust them as necessary. Such proactive measures further showcase your dedication to their success and security. Cultivate a relationship where clients feel comfortable approaching you for guidance on both financial and non-financial matters. When clients trust you as a resource beyond just professional advice, they will not only maintain lasting relationships with you, but they will also act as advocates, referring you to others in need of financial coaching.

In conclusion, building client trust as a financial planning coach requires a multifaceted approach. Prioritize communication, transparency, and expertise to create strong bonds with clients. Personalized experiences and encouragement towards independence can set the stage for a successful coaching relationship. Utilize technology efficiently to offer superior services that cater to modern client needs. Remember that establishing long-term relationships takes time but is incredibly rewarding. Your ongoing commitment will forge an unwavering bond that promotes collaboration and loyalty, ensuring clients feel secure in their financial journeys. Focus on creating an atmosphere of empathy and understanding, allowing clients to be vulnerable with you about their finances. Regularly analyze client progress and provide continuous support to reinforce their trust in your abilities. Lastly, educate your clients, allowing them to develop a comprehensive understanding of their financial landscape. When clients feel empowered and confident, they are more likely to engage with the process actively. Building trust is an evolving journey, ultimately resulting in lasting partnerships that benefit both you and your clients.