Mobile Payment Solutions and Their Role in Marketing Strategy

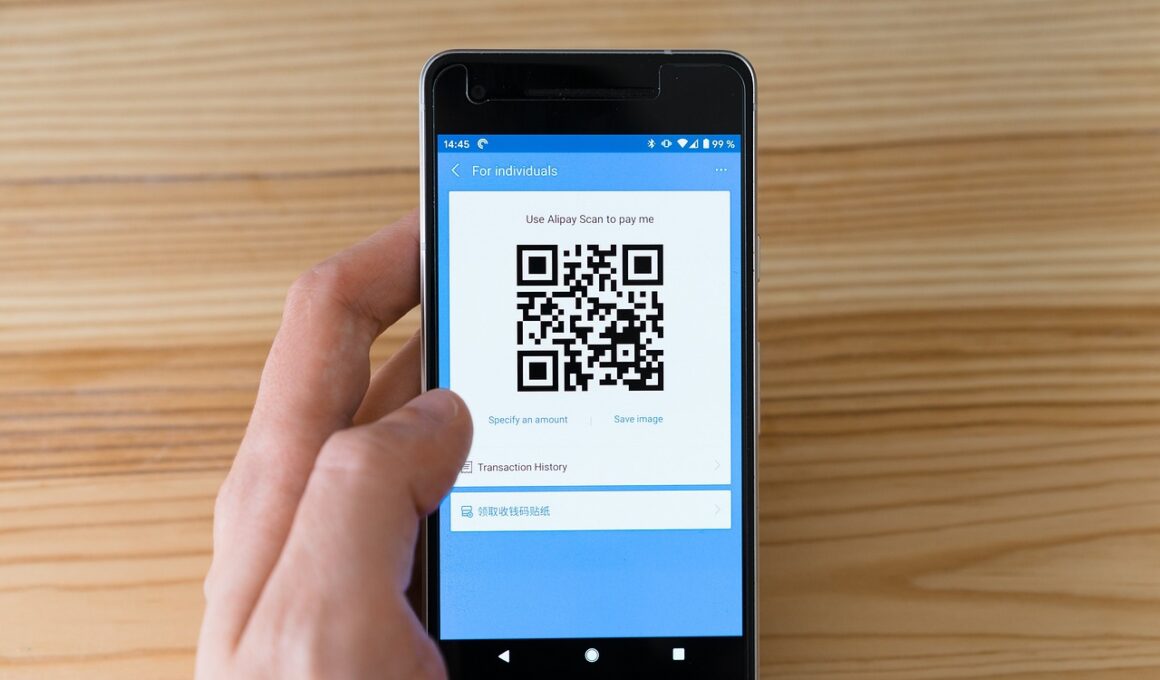

Mobile payment solutions are revolutionizing the way businesses approach their marketing strategies. With the rise of smartphones and mobile applications, the convenience of mobile payments has become a significant factor for consumers when making purchasing decisions. Companies must adapt their marketing strategies to incorporate mobile payment options to keep up with the competition. By leveraging mobile payments, businesses can create a seamless purchase experience that enhances customer satisfaction. This integration helps brands foster loyalty and encourage repeat purchases. Furthermore, utilizing mobile payment solutions allows companies to collect valuable data on consumer behavior, enabling targeted marketing efforts. Brands can analyze this data to identify trends and preferences, leading to tailored promotions and personalized communication. As mobile payments continue to grow, businesses that embrace this trend can differentiate themselves in the market, attract new customers, and boost sales. Mobile payment solutions also provide opportunities for innovative marketing campaigns, such as mobile wallets and QR code promotions. These strategies not only facilitate transactions but also engage customers in creative ways that enhance their overall shopping experience.

Furthermore, the integration of mobile payment solutions in marketing strategies aligns perfectly with the increasing consumer preference for convenience. According to recent studies, a significant portion of consumers expressed that ease of payment plays a crucial role in their purchasing choices. Marketers are recognizing the importance of mobile payment systems, as these tools can streamline the checkout process and reduce cart abandonment rates. With many consumers now opting for mobile transactions over traditional methods, businesses are compelled to prioritize mobile-friendly websites and applications. By optimizing their platforms for mobile payment, organizations can provide faster service, enhancing customer satisfaction and loyalty. Speed and security are essential features that consumers look for, and by offering trusted mobile payment options, businesses can instill confidence in their customer base. Companies can also utilize loyalty rewards linked to mobile payments to incentivize repeat purchases and customer engagement. As consumers become increasingly tech-savvy, their expectations around payment experiences continue to evolve, and businesses can leverage mobile payments to not only meet these expectations but also exceed them, solidifying their position in the market.

The Advantages of Mobile Payment Integration

Integrating mobile payment solutions opens up a range of advantages for companies looking to enhance their marketing strategies. First and foremost, mobile payments provide an improved customer experience. Today’s consumers value quick and convenient purchasing options, and mobile payments facilitate this need by enabling transactions through their devices. Reducing friction during the checkout process leads to higher conversion rates, which is critical for any business. Additionally, mobile payments often come with advanced security features that reassure consumers, allowing them to transact with confidence. This is important as trust in the payment process remains a significant concern for many shoppers. Effective marketing strategies now incorporate educational content about the safety and ease of mobile payments, retaining customer interest. Another vital aspect is the analytical insights gained from mobile payment data. This information can detect patterns in customer preferences and inform marketing campaigns, helping businesses customize their offerings more effectively. Adopting mobile payment solutions leads to greater consumer trust, enhanced marketing capabilities, and, ultimately, increased sales, highlighting the need for businesses to modernize their payment landscape.

Moreover, mobile payment solutions can be a strategic asset for small businesses looking to expand their reach. With lower overhead costs and ease of setup, mobile payment systems have become increasingly accessible to entrepreneurs. This helps small retailers effectively compete against larger competitors, leveling the playing field. Mobile payments allow small businesses to attract tech-savvy consumers who may prefer to shop at establishments that offer modern conveniences. By accepting mobile payments, small shops can foster a tech-friendly image, appealing to younger generations. Additionally, mobile payments offer flexible solutions that align well with social media marketing. Brands can encourage mobile payment use through promotions shared on platforms such as Instagram and Facebook. Further, some businesses utilize social media to run campaigns that reward mobile payments with discounts or loyalty points. These tactics engage customers and derive significant value from their transactions. Hence, the intersection of social media, mobile payments, and marketing strategies forms a powerful trifecta that drives sales and promotes brand loyalty.

Challenges in Mobile Payment Marketing

Although mobile payment solutions provide numerous benefits for marketing strategies, several challenges must be addressed. One primary concern is the variability in consumer adoption rates across different regions. While urban areas may quickly adapt to mobile payments, rural locales might lag behind due to limited technological infrastructure or consumer hesitance. Companies need to identify their target demographics and tailor their marketing strategies accordingly. Moreover, confusion around the various mobile payment platforms can hinder adoption. Consumers may feel overwhelmed by the choices available, leading to frustration and hesitation. As marketers, simplifying the message regarding mobile payment options—focusing on their benefits and simplicity—becomes paramount. Additionally, the evolving regulatory landscape around mobile payments presents hurdles for businesses. Compliance with local laws can vary widely, affecting how businesses integrate and promote mobile payment solutions. Marketers should stay informed about legal requirements in their respective regions, affecting their advertising and promotion strategies. Recognizing and addressing these challenges can significantly enhance the effectiveness of marketing efforts for mobile payment solutions.

In summary, implementing mobile payment solutions within marketing strategies offers multiple opportunities for enhancing consumer engagement and satisfaction. Businesses that embrace these advanced technologies are better positioned to respond to the evolving needs of consumers actively seeking convenience and security. Mobile phones have become ingrained in daily life, which is why payment options integrated into these devices should be a priority for innovative marketers. As competition intensifies, it is crucial for brands to remain ahead by investing in solutions that streamline the purchasing process, thereby increasing customer retention rates. Additionally, through analytics gathered from mobile payment transactions, businesses can craft personalized marketing messages that resonate with their target audience. It, in turn, leads to more successful campaigns and improved sales. As brands adopt mobile payment methods, they should also focus on reinforcing customer trust and reliability within their marketing efforts. Investing not only in the technology but also in consumer education will be vital for future growth. Being responsive to consumer demand and leveraging mobile payments effectively positions brands as leaders in the industry.

Looking Ahead: The Future of Mobile Payments in Marketing

The future of mobile payments promises exciting opportunities for marketers looking to refine their strategies. Emerging technologies such as contactless payments and biometric verification are set to redefine consumer interactions. With these advancements, consumers will demand even more personalized experiences when making purchases. As artificial intelligence integrates further with mobile payment platforms, marketers will have unprecedented access to data analytics for hyper-targeted campaigns. The capability to analyze consumer behavior in real-time ensures that businesses can adapt their marketing approaches on the fly. Moreover, the increasing prevalence of mobile wallets provides shoppers with additional incentives to engage with brands. Marketers can create exclusive offers and rewards tied to mobile wallet usage, encouraging consumers to opt for these payment methods. Furthermore, mobile payment solutions will likely weave into social commerce, further enhancing customer experience and streamlining purchasing through platforms like Instagram and Facebook. As marketers continue to experiment with innovative tactics within mobile payment frameworks, they will need to prioritize user experience alongside technological advancements to maintain relevance and foster lasting connections with consumers.

In conclusion, the intersection of mobile payment solutions and marketing strategies presents a transformative opportunity for brands in an increasingly digital world. Companies that recognize the potential of mobile payments in enhancing customer engagement will undoubtedly stand out in the marketplace. This innovative approach not only drives sales but also allows businesses to develop closer relationships with consumers through personalized experiences. As mobile payment technology develops, marketers must remain adaptable and understand the emerging trends shaping consumer behaviors. The successful integration of mobile payments into marketing strategies requires a commitment to consumer trust, security, and a seamless user experience. Brands that achieve success in this area will be able to rise above the noise and drive meaningful engagement with their audiences. Thus, the future of marketing will undoubtedly be influenced significantly by the evolution of mobile payment solutions. Businesses ready to embrace this change will be poised for growth and innovation, ultimately leading to established customer loyalty and market leadership. Leveraging mobile payment solutions is no longer an optional add-on; it is a necessity in building competitive marketing strategies that resonate with today’s consumers.