Understanding Business Insurance for Crisis Management

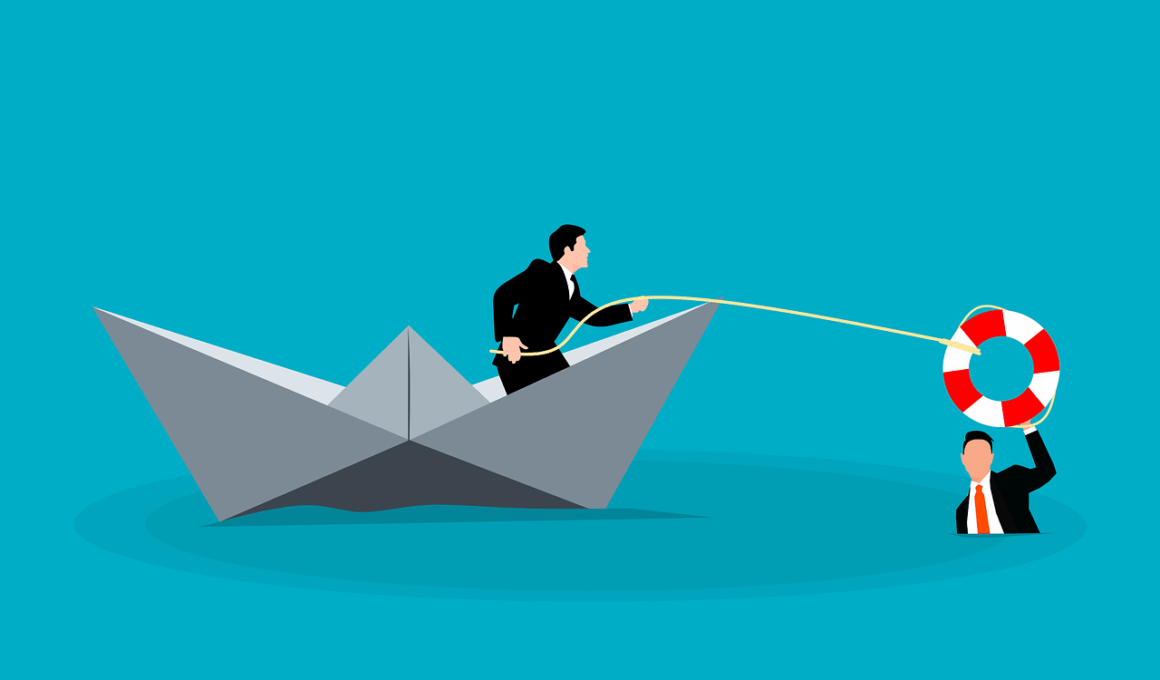

In the ever-evolving landscape of business, crisis management has become crucial. Companies must effectively navigate financial uncertainties which could arise from unforeseen events. Business insurance serves as a significant tool in managing these crises by providing avenues for risk transfer. Notably, business interruption insurance holds particular importance, protecting revenues when operations cease due to emergencies. In addition, liability insurance covers legal repercussions that can emerge from accidents. Businesses often face risks from natural disasters such as floods or earthquakes. The right insurance can mitigate losses and ensure longevity. Furthermore, assessing specific vulnerabilities within a company can aid in choosing appropriate policies. Analyzing previous crises your business faced will help in identifying the necessary coverage. For example, if your area is prone to hurricanes, then including specific coverage for such events becomes vital for survival. Additionally, employee training should be an integral part of crisis management strategies. Ensuring that all employees understand their roles during a crisis enhances the company’s resilience. Properly structured insurance partnerships also play a key role in ensuring businesses are protected during unpredictable times, allowing for a swift recovery after a crisis.

Understanding the various types of business insurance policies is essential. Each policy caters to different risks that a business may encounter during its operating life. The first kind of insurance is property insurance, which safeguards against damages to your commercial space due to fire, theft, or vandalism. Another crucial policy is workers’ compensation insurance that protects businesses from legal liability related to employee injuries incurred at work. Many companies also engage clients with professional liability insurance. This coverage protects against claims for negligence or failure to deliver services on time. The costs of these insurance plans can vary significantly based on multiple factors. Additionally, geographical location can impact rates, especially for businesses in areas more prone to specific risks. Seasonal businesses might require different insurance strategies given their operational schedule and associated risks. To ensure adequate coverage, businesses need regular assessments of their insurance needs. This consistent evaluation helps adjust policy limits and pricing in line with current risks. Discussing with an insurance advisor could provide valuable insights into policy options. Moreover, understanding the exclusions in a policy is critical to avoid surprises during crises when they need coverage the most.

Evaluating Risks in Business Operations

Every business has unique operational risks that must be assessed to implement effective insurance solutions. Conducting a comprehensive risk assessment enables businesses to identify potential threats to their operations. This process involves evaluating aspects like financial performance, supply chains, and regulatory environments. Financial risks can arise from market fluctuations or rising operational costs, impacting profitability. Meanwhile, supply chain vulnerabilities may lead to disruptions from supplier issues or logistics failures. It is crucial to prioritize the most significant risks during evaluations. Once identified, businesses can consider various insurance products specifically tailored to mitigate these identified risks. For instance, companies facing substantial technological threats should look into cyber liability insurance, which protects against data breaches and related financial losses. Regular audits of these risk areas should complement the assessment to ensure no emerging risks are left uncovered. Additionally, companies should engage employees in this process by encouraging them to voice their concerns and observations. This inclusivity can help spot possible issues in daily operations that management might overlook. Ultimately, a comprehensive risk assessment paired with tailored insurance solutions enhances a business’s resilience against crises.

Incorporating a solid crisis management plan is instrumental for risk management within a business. Developing plans for various potential crises requires thorough research into industry-specific threats. A good crisis management plan includes clear communication channels that help in disseminating information quickly and efficiently during times of stress. Internal and external communication strategies should be predefined, enabling prompt engagement with employees and stakeholders. Furthermore, employee training workshops can ensure that everyone understands their roles during a crisis. Regular simulations of potential crises can provide practical experience, preparing employees for real situations. These drills should emphasize the importance of adhering to established protocols in stress. Additionally, reviewing and updating the crisis management plan periodically ensures its relevance in the fast-paced business environment. Changes in market conditions, technology, or regulatory frameworks may influence operational dynamics, warranting adaptations in the plan. Integrating technological solutions can improve crisis management efforts. For instance, using enterprise resource planning software can assist in coordinating responses more effectively. Overall, a comprehensive crisis management plan serves as the backbone for effectively handling crises, ensuring business continuity, and protecting assets during distress.

The Role of Insurance Agents and Brokers

Engaging with an experienced insurance agent or broker brings expertise that can enhance a business’s insurance purchasing strategy effectively. These professionals play a vital role in assessing an organization’s unique needs and helping navigate the complex insurance landscape. By linking businesses with suitable insurance products, they assist in securing tailored coverage essential for risk management. Furthermore, they can offer valuable insights about market trends and insurance innovations. One core function of an insurance broker includes conducting thorough policy comparisons to ensure that businesses receive the best value for their premium costs. Additionally, brokers can provide support during claims processes, ensuring businesses understand their rights and responsibilities. This advocacy can be particularly beneficial when dealing with disputes or denials. Moreover, establishing a professional relationship with an insurance agent allows businesses to receive ongoing guidance as their needs evolve over time. Regular check-ins can facilitate discussions around adjusting coverage as operational changes occur. Ultimately, leveraging the expertise found in established relationships with agents can amplify a business’s approach to successful crisis management through comprehensive coverage.

The interplay between insurance and risk transfer strategies is fundamental to crisis management. Businesses need a thorough understanding of both conceptual and practical aspects of risk transfer options to optimize their protection. Among different strategies available, self-insurance is becoming increasingly popular as businesses set aside funds to cover potential losses, mitigating the need for extensive external insurance. However, businesses must weigh the pros and cons before pursuing self-insurance, considering their capacity to absorb risks. One critical factor to consider is cash flow, ensuring that the organization possesses sufficient reserves to handle potential losses. On the other hand, working with insurers can enhance risk management efforts by distributing potential liabilities across various policies. These policies may cover a wide range of risks such as reputational, operational, and cyber threats. Particularly, businesses operating in high-risk industries need specialized strategies involving tailored coverage. Additionally, incorporating multiple coverages under a single insurer may provide cost savings while ensuring comprehensive protection against diverse risks. Thus, understanding varied risk transfer mechanisms equips businesses with knowledge on optimizing their approach towards crisis management and financial sustainability.

Conclusion: The Path Forward

The importance of business insurance in crisis management cannot be overstated. A robust insurance strategy forms a safety net that allows companies to navigate unexpected challenges effectively. Collaborating closely with experienced professionals, conducting regular assessments, and creating comprehensive plans ensures that businesses are equipped to tackle unforeseen adversities. It is essential to foster a culture of preparedness where all stakeholders are involved actively in crisis management initiatives. Keeping abreast of new insurance products and regulatory changes enhances a company’s agility in addressing emerging risks. This proactive approach should be embraced, transforming insurance from a mere necessity to a strategic asset in managing business operations. Finally, organizations should nurture an adaptive mindset, understanding that continuous improvement is vital in both insurance frameworks and crisis planning. Regularly updating policies will not only align with evolving business needs but also enhance confidence among stakeholders. In this dynamic environment, ensuring that your business remains resilient amid risk will be paramount. Ultimately, with careful planning and proper insurance coverage, organizations can weather any storm, foster growth, and build a sustainable future.

Tehtkawnl.