The Evolution of Mobile Payment Technologies: A Comprehensive Overview

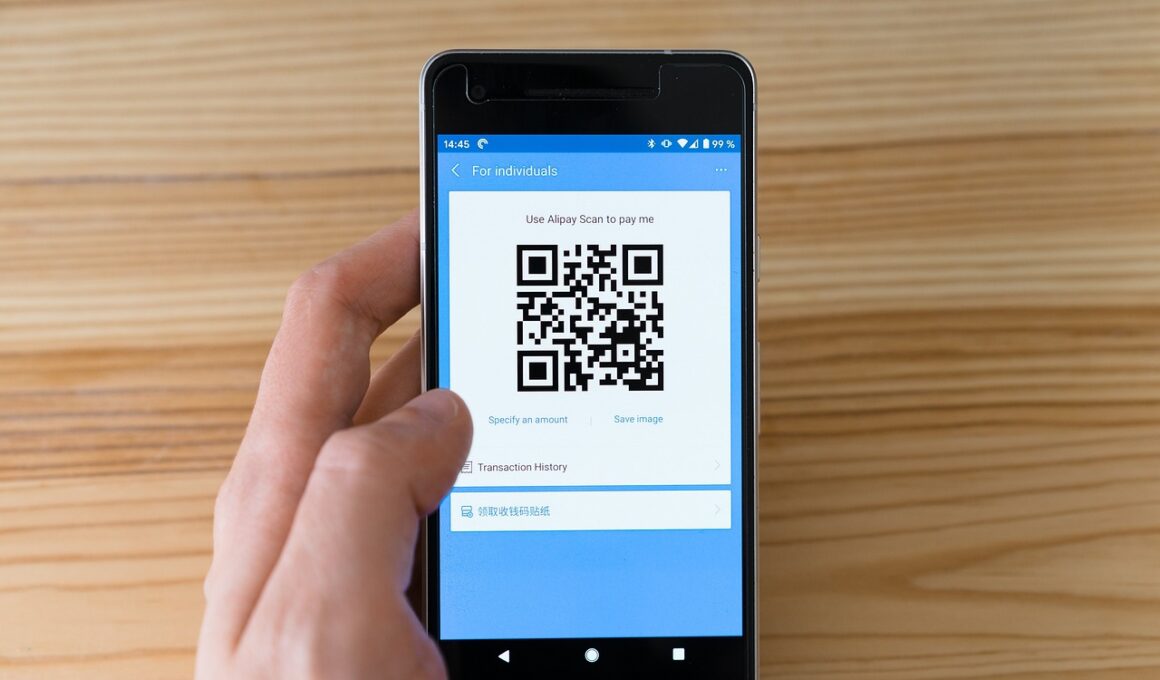

Mobile payment technologies have transformed significantly over recent years, reshaping how consumers transact daily. The evolution began with basic SMS payments, where users could purchase items via text messages. As technology advanced, more sophisticated solutions became available, enabling users to make transactions through mobile apps. Digital wallets such as Apple Pay and Google Wallet emerged, allowing users to store card information and pay through Near-Field Communication (NFC). Furthermore, QR codes gained popularity, especially in regions like Asia, where consumers could scan codes to make purchases effortlessly. Another noteworthy innovation is the integration of biometric authentication, which enhances security, making payments safer for users. As the technology continues to evolve, additional features such as loyalty programs and rewards systems are becoming integrated into mobile payment platforms. Moreover, merchants are encouraged to adopt these technologies, offering discounts or promotions to attract users. There is a growing need for adaptability in mobile payment systems, responding to the diverse consumer preferences and behaviors. As we explore further advancements in mobile payments, it becomes evident that the market is continually evolving to address the emerging demands of digital consumers.

Key Mobile Payment Technologies to Watch

Mobile payment technologies encompass several key components that are revolutionizing the financial landscape. One prominent technology is NFC, which allows contactless transactions between mobile devices and payment terminals. Consumers can tap their phones to make payments swiftly, enhancing convenience. Additionally, digital wallets have undergone substantial growth, with enhanced features including peer-to-peer transactions, bill splitting, and transaction histories. Services such as Venmo and Cash App are great examples of this trend, appealing to younger demographics. Another noteworthy technology is blockchain, facilitating secure transactions while ensuring user privacy. It has the potential to enable decentralized payment systems, reducing reliance on traditional banks. QR code payments are also gaining traction, particularly in markets like China, where users can easily scan codes to pay, further simplifying the transaction process. Integration of Machine Learning and AI in fraud detection systems is improving security and efficiency in payment processing. Moreover, the growing acceptance of cryptocurrencies in mainstream commerce is shaping the future of mobile payments. As these technologies evolve, businesses must stay informed to adapt their practices and provide seamless payment experiences to consumers.

The security of mobile payment technologies is paramount, as consumers increasingly rely on their devices for financial transactions. Several measures have been implemented to protect user data and enhance transaction security. For instance, two-factor authentication (2FA) adds an extra layer of protection by requiring verification through another device or method. Encryption also plays a vital role, securing sensitive information transmitted during transactions. Additionally, biometric authentication methods such as fingerprint scanning or facial recognition provide a user-friendly yet secure means of confirming identity. Companies are continuously developing strategies to address and mitigate vulnerabilities, especially given the rise in cybersecurity threats globally. Regulatory frameworks are also evolving, with governments implementing stricter compliance measures to ensure user protection. As technology advances, mobile payment platforms must enhance their security protocols to build consumer trust. Consumers are encouraged to remain vigilant and utilize security features provided by payment platforms to protect their financial information. Staying informed about potential risks and understanding how to safeguard personal data can significantly reduce the likelihood of security breaches. Ultimately, a collaborative approach between technology providers and consumers is crucial for establishing secure mobile payment ecosystems.

Future Trends in Mobile Payment Technologies

The future of mobile payment technologies appears promising, driven by innovation and changing consumer habits. One intriguing trend is the rise of voice-activated payments, allowing users to complete transactions using voice commands through virtual assistants. This technology enhances ease of use and aligns with the growing adoption of smart home devices. Furthermore, the integration of augmented reality (AR) into mobile payments offers exciting possibilities, allowing consumers to visualize products before purchasing directly from their mobile devices. This trend could reshape retail experiences significantly. In addition, as 5G technology rolls out globally, it will likely enhance mobile payment capabilities, providing faster transaction speeds and improving connectivity in crowded areas. Merchants will benefit from smoother operations and improved customer experiences as a result. Furthermore, ethical considerations related to sustainability are becoming increasingly prominent in consumer decision-making. Mobile payment providers must adapt to these expectations, developing solutions that promote eco-friendly transactions. Furthermore, educational outreach around these technologies is essential, enabling consumers to understand their benefits and how to utilize them effectively. Overall, staying ahead of these trends will be crucial for businesses looking to thrive in an ever-evolving digital landscape.

Interoperability is a key focus in the mobile payment technology landscape, ensuring that various systems work seamlessly together. The growing number of payment platforms necessitates compatibility between different services, enabling smoother transactions across multiple systems. Consumers expect their mobile wallets to function universally, regardless of the platform. Initiatives are emerging to create open standards and frameworks that facilitate this interoperability, allowing users more choices and flexibility. As consumers increasingly demand integrated solutions, companies are now prioritizing partnerships and collaborations to enhance compatibility across ecosystems. Additionally, regulatory developments surrounding interoperability are pushing platforms toward adopting more open systems, fostering innovation and competitiveness in the market. As mobile payments continue to revolutionize commerce, it is essential for platforms to prioritize user experience and convenience. Speed and efficiency of transactions remain non-negotiable aspects that drive consumer satisfaction. In conclusion, a focus on interoperability can significantly enhance the overall appeal of mobile payment technologies, ensuring that users experience a frictionless payment process. As trends shift, companies must remain agile, adapting to consumer expectations and technological advances to maintain relevance in this dynamic market.

The Role of Mobile Payments in Commerce

Mobile payment technologies have become invaluable in today’s commerce, reshaping how businesses and consumers interact. Digital transactions provide efficiency, allowing customers to complete purchases swiftly, thereby enhancing overall shopping experiences. Companies adopting these technologies can access a broader customer base, tapping into the preferences of tech-savvy consumers who prioritize convenience. Furthermore, mobile payments allow businesses to streamline their operations, reducing the need for physical cash handling. This transition can lead to increased security and reduced operational costs. In addition, integration with e-commerce platforms allows for a seamless shopping journey, enabling customers to browse, select, and pay all from their mobile devices. Analytics from mobile payments can also provide insightful data regarding consumer behavior, helping businesses tailor their offerings accordingly. The pandemic accelerated the adoption of mobile payments and highlighted their importance in contactless experiences. As businesses shift towards a digital-first approach, ensuring they are equipped with the latest mobile payment technologies is essential. This shift not only increases customer satisfaction but also raises the potential for brand loyalty. Ultimately, mobile payments are reshaping the landscape of commerce, propelling businesses into the future.

Mobile payment technologies play a critical role in fostering financial inclusion, especially in underbanked regions. These technologies provide accessible payment options for individuals who may not have access to traditional banking services. Mobile payments enable users to transact easily, even without a bank account, through services that utilize SIM cards or mobile money platforms. This inclusivity is significantly transforming the economic landscape, enabling small business owners to thrive and participate fully in the economy. Additionally, mobile payments help drive local economies by facilitating commerce at lower transaction costs. Governments and NGOs are also increasingly partnering with mobile payment providers to offer financial literacy programs, educating users on how to optimize these technologies for their benefit. These initiatives can empower users to take control of their finances while encouraging savings and responsible spending. Furthermore, as trust in mobile payment security continues to grow, adoption rates are expected to rise. The possibilities for mobile payments to address socioeconomic disparities are vast, presenting opportunities to uplift communities globally. In summary, with continued innovation, mobile payment technologies can bridge the gap between consumers and financial services, promoting economic growth and social equity.